On January 17, 2020 Fix Our Schools went to Queen’s Park and sat before the Committee of Finance and Economic Affairs as part of the pre-budget consultation process. Our first ask of this committee was to ensure both adequate and stable provincial funding to publicly funded education and schools.

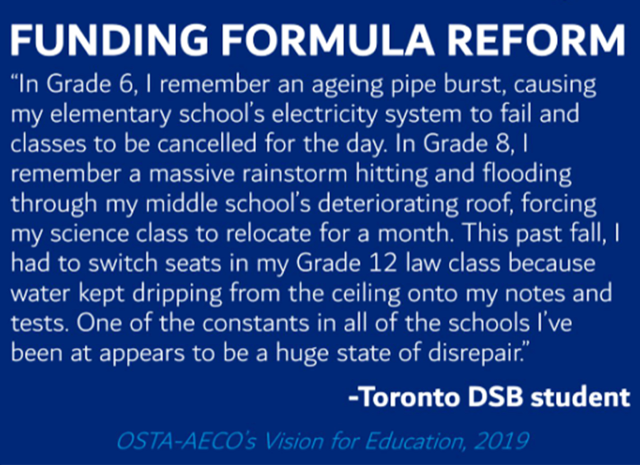

Without adequate funding, school boards simply cannot meet the goals they need to achieve – such as keeping their school buildings in a state of good repair. Even though this seems like a ridiculously obvious statement, we know that for over twenty years Ontario’s provincial government only provided a small fraction of the $1.4-billion/year that industry standards suggest was required for school boards to be able to properly maintain their school buildings. In fact, when the Fix Our Schools campaign began in 2014, provincial funding to school boards for school repair and renewal was only $150-million/year – one-tenth of the $1.4-billion/year needed!

The provincial funding dynamic for public schools is akin to a parent giving their child $10 and expecting that child to purchase a week’s worth of groceries for a family of four people. We think you’d agree that the child in this example would not be able to realistically meet the goal outlined, given the completely inadequate funding provided by the parent? School boards are like children in that they rely exclusively on the “parent” provincial government to provide adequate funding. We think you’d agree that school boards would not be able to realistically be able to keep their school buildings in a state of good repair, given that provincial funding for over two decades has been grossly inadequate?

The provincial funding dynamic for public schools is akin to a parent giving their child $10 and expecting that child to purchase a week’s worth of groceries for a family of four people. We think you’d agree that the child in this example would not be able to realistically meet the goal outlined, given the completely inadequate funding provided by the parent? School boards are like children in that they rely exclusively on the “parent” provincial government to provide adequate funding. We think you’d agree that school boards would not be able to realistically be able to keep their school buildings in a state of good repair, given that provincial funding for over two decades has been grossly inadequate?

And yet, our provincial government holds school boards completely responsible for the $16.3-billion of disrepair that has accrued in publicly funded school boards over that period. Fix Our Schools find this situation to be frustrating and unacceptable and has proposed that an additional $1.6-billion/year in provincial funding is needed in order for school boards to have a realistic chance of eliminating the $16.3-billion repair backlog in Ontario’s schools within 7-8 years.

Our second request to the Committee of Finance and Economic Affairs was that provincial funding to school boards be stable and predictable. Again, this seems ridiculously obvious that in order for school boards to be able to forward plan and operate in the most effective and efficient manner, they need to know their funding from year to year and be able to count on that funding. However, the reality for school boards over the last 22-years is that each year, they wait with baited breath to find out annual provincial funding; and also frequently deal with mid-year cuts to this funding. This is absolutely unacceptable if school boards are to operate efficiently and effectively.

An example of the degree to which inadequate and unstable provincial funding can disrupt the publicly funded education system and schools is provided in this CTV News Article of January 27, 2020 entitled, “CUPE Claims Ford government not holding up its end of the bargain”.

In this article, the Canadian Union of Public Employees (CUPE), which is the union representing education workers such as caretakers, early childhood educators and lunchroom supervisors, says “the government agreed to restore $78 million in funding to re-hire 1,300 staff across provincial school boards” and “the money was supposed to flow to local school boards at the beginning of the 2019-2020 school year” – “but the money has yet to leave the government’s bank account.” In this article, the government said the money cannot be released until all education-sector unions have signed new contracts, which appears to have been very different from CUPE’s understanding. This misunderstanding has resulted in ongoing inadequate provincial funding and introduced instability to the flow of funding as well. As Fix Our Schools has always maintained, adequacy and stability of funding is key to effectiveness and efficiency.